Blog

How rising standards are reshaping transport in the chemical sector

The chemical industry is one of the most complex and simultaneously one of the most demanding sectors of the economy. It supplies raw materials, intermediates and finished products that form the foundation of nearly every other industrial branch. In Poland, its importance is particularly significant. According to the report by the Polish Chamber of Chemical Industry (PIPC), the value of sold production in 2025 reached 442 billion PLN, representing 17.7 percent of the country’s total industrial output. This scale of operations brings not only immense responsibility but also a strong dependence of production processes on the quality of logistics.

In recent years, chemical companies have been facing rapid transformations that affect not only production models but also cost structures, supplier relations and approaches to logistics. The driving forces behind these changes include increasingly stringent EU regulations, rising customer expectations regarding transparency and safety, strong environmental pressure and the need to shift toward sustainability and technological innovation. These challenges are further intensified by changing market conditions. According to the report “In Search of the ‘Green Middle’. Current Situation, Challenges and Prospects of the Chemical Sector in Poland” published by Bank Pekao in May 2025, the EU chemical industry accounted for only 13 percent of global chemical production in 2023, compared with 23 percent in 2008. Poland, although dealing with similar problems as the rest of the EU, has managed to increase its share of EU exports in areas such as pesticides, household chemicals, paints and plastics. As early as the second half of 2023, production began to rise, reaching in 2024 a level 3 percent higher than in 2021. For comparison, during the same period chemical production across the EU fell by 17 percent.This demonstrates the strong adaptability of Polish companies and their growing competitiveness, particularly in specialised segments. (www.pekao.com.pl)

Safety in the transport of chemical substances. The top priority and at the same time the greatest challenge

The transport of chemicals falls into the category of high-risk operations. Each substance comes with its own requirements for storage, packaging, labelling and handling, and in the case of hazardous materials, ADR regulations apply. The driver must be trained and certified to transport substances defined under the ADR agreement. The vehicle must be properly equipped in compliance with the regulations, and the carrier must be able to demonstrate that risk-mitigation procedures are in place.

Main segments of the Polish chemical industry:

Bulk chemicals

Also known as “large-scale chemicals,” it includes high-tonnage, widely used products, excluding fuels.

Chemical processing

The production of finished goods using previously manufactured high-tonnage bulk products as the base.

Fuels and petroleum refining products

A segment that includes, among others, gasoline, diesel fuels, lubricants and other products generated in the petroleum refining process.

Low-tonnage chemicals

A group of high-margin specialty products used in relatively small quantities.

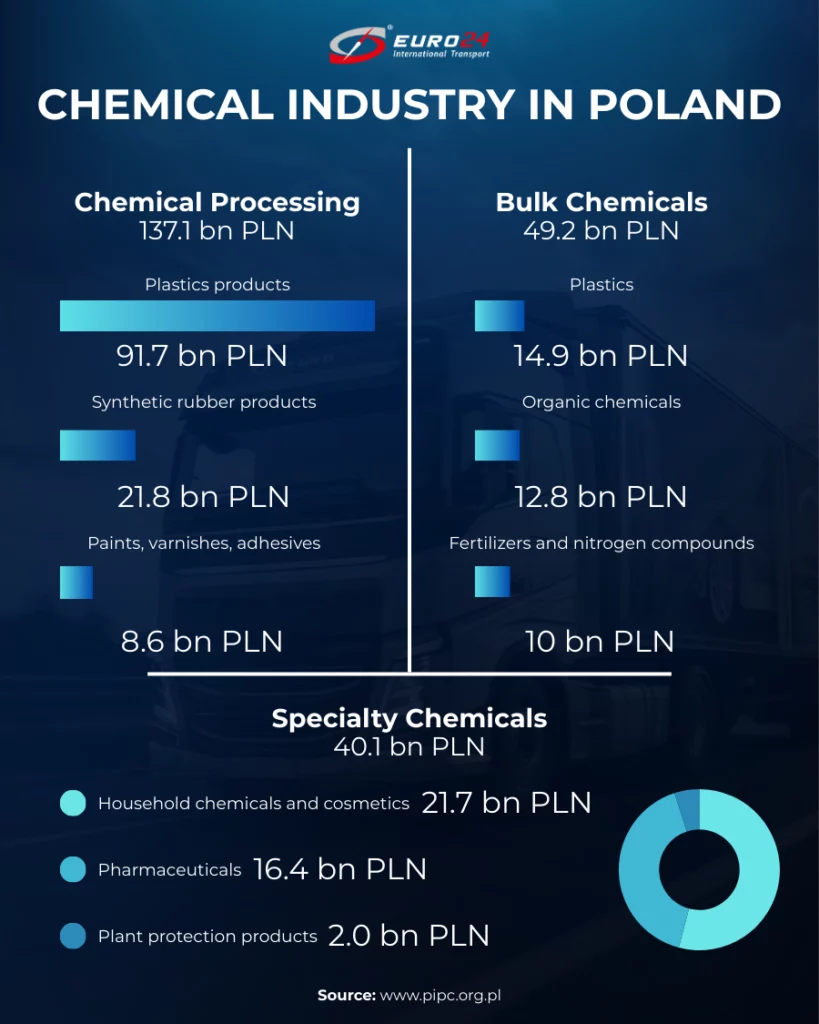

Data on the value of sold production in the Polish chemical industry in 2024 (www.pipc.org.pl),clearly shows which segments dominate the sector’s structure. The largest share belongs to chemical processing, which reached as much as 137.1 billion PLN. Among processed products, the most significant are plastics (91.7 billion PLN), followed by synthetic rubber products (21.8 billion PLN), and paints, varnishes and adhesives (8.6 billion PLN). Fuels and petroleum refining products reached a similar overall value. Bulk chemicals totalled 49.2 billion PLN, with the largest contributions coming from plastics (14.9 billion PLN), organic chemicals (12.8 billion PLN) and fertilizers and nitrogen compounds (10.0 billion PLN). Low-tonnage chemicals, a segment dominated by household chemicals and cosmetics (21.7 billion PLN), pharmaceuticals (16.4 billion PLN), and crop protection products (2.0 billion PLN), reached a combined value of 40.1 billion PLN. Such a complex production structure directly translates into strict logistical requirements. Transport in the chemical industry cannot be treated as a standard service, because it is a high-risk operation requiring full compliance with ADR regulations, precisely prepared documentation and correct labelling. Any failure to meet these obligations may result in inspections, transport stoppage, fines and the need to reorganise the entire logistics operation. Road inspections show that the most common errors include improper labelling, incomplete transport documentation and inadequate cargo securing.

In the case of chemical substances, even a minor oversight can lead to real production losses, as delivery delays disrupt the continuity of technological processes. This is why a responsible carrier must ensure not only regulatory compliance, but also a well-trained team, a properly prepared fleet and an effective internal control system. In the chemical industry, safety is not an added value, it is the starting point for the entire supply chain.

ADR plates display two identification numbers:

The Hazard Identification Number (HIN) Two or three digits shown in the upper part of the plate (the top field), indicating the type of danger.

The UN Number (UN) Four digits in the lower part of the plate (the bottom field), identifying the specific hazardous substance.

Chemicals require precise environmental parameters

Chemical substances are particularly sensitive to temperature deviations, light, humidity and the cleanliness of the transport environment. Some react when exposed to air, others to moisture, and many require temperature fluctuations to be kept within just a few degrees. In practice, this means using trailers and vehicles that can guarantee stable transport conditions. Cleanliness of the transport unit is equally important. In tanker transport, cleanliness certificates and tightness confirmations are standard, as even trace amounts of a previous load can trigger a chemical reaction. For container and palletised transport, full insulation from external factors is crucial.Real-time temperature monitoring is playing an increasingly important role, as it enables quick detection of deviations. At the same time, the importance of a transport fleet adapted not only to technical requirements but also to CO₂ reduction is growing. Under the EU climate policy schedule, the phase-out of free emission allowances will begin in 2026. According to Bloomberg NEF forecasts, the price of one tonne of CO₂ may rise to over 150 euros, which will have a direct impact on transport costs. Investing in greener vehicles and trailers is therefore not only a response to regulations but also a real investment in competitiveness. A fleet aligned with ESG principles, reducing emissions and adapted to the demands of the “green transition,” will be a key asset in cooperation with chemical plants, which themselves are obliged to report their carbon footprint and maintain compliance with EU environmental regulations. (www.pekao.com.pl)

Chemical documentation. Precision determines the success of the transport

Documentation in chemical transport is significantly more complex than in most other sectors. The essential documents include the Material Safety Data Sheet (MSDS), the CMR consignment note with proper goods classification, the written ADR instructions and documents confirming the driver’s and vehicle’s authorisations. In the case of hazardous waste, the BDO register and the Waste Transfer Card are mandatory.Imprecise documentation, missing data or incorrect classification of the goods can lead to an immediate vehicle stoppage and fines. For this reason, the carrier must have experience in handling chemical documentation and ensure internal verification of data accuracy. In the chemical industry, documentation often determines whether the transport will proceed according to plan.

The BDO register

The BDO register is a database maintained by the regional marshal that includes entities placing products or packaged products on the market, as well as those managing waste. Until recently, the transport of waste required specific permits, which have now been replaced by entry in the BDO register. The register contains a list of waste codes. The rules governing the transport of waste are defined in the Regulation of the Minister of the Environment of 7 October 2016, in force since 24 January 2018. All entities obliged to keep records and submit reports related to waste management must be registered in the BDO system.

The importance of communication and full transport transparency

Chemical companies expect full visibility of their deliveries primarily due to safety considerations. Every substance carries a certain level of risk, which is why constant oversight of its movement becomes a key element in protecting people, the environment and plant infrastructure. Having access to information about where the shipment is, under what conditions it is being transported and whether the route is proceeding as planned helps minimise the risk of unwanted incidents. For this reason, the carrier must provide continuous status updates, vehicle location monitoring and the possibility of contact at any time. Modern telematics systems allow real-time tracking of transport parameters and quick response to situations that require intervention. Chemical plants are also increasingly implementing advanced reporting systems that document the entire operation and confirm that the transport meets the safety procedures in place at the facility.

Transport Monitoring

Transport monitoring at Euro24 is an advanced logistics service that ensures full control over international deliveries. With a dedicated Control Tower department available 24 hours a day, 7 days a week, clients receive real-time updates on the status of their shipments at every stage of the transport process. The service includes verification of transport documentation, vehicle location tracking and immediate response in the event of unexpected situations such as breakdowns or delays.

Costs and economic pressure. Why there is no room for false savings

The transport of chemicals is capital-intensive because it requires the use of specialised vehicles that meet strict technical requirements, as well as continuous improvement of driver qualifications. The fleet must remain fully compliant with ADR regulations, which involves regular inspections, equipment replacement, documentation checks and ongoing updates to safety procedures. Each of these elements generates costs, yet they form the foundation of safe operations involving materials that, in many cases, pose real risks to people and the environment.

As a result, even seemingly small savings in the transport area can lead to serious operational and legal consequences. The transport services market remains competitive, but the carriage of chemical substances operates in a completely different risk category than standard deliveries. Clients in the chemical sector increasingly emphasise that the criteria for selecting a carrier must be based on experience, operational transparency, expertise in documentation and full compliance with national and European regulations. Price is no longer the primary factor, because logistical errors can cause production downtime, financial losses, loss of certification and the risk of environmental incidents. For this reason, a carrier that invests in operational quality becomes the partner of choice for the chemical industry. Operational stability, process predictability, full adherence to safety requirements and readiness for customer audits build the level of trust that is absolutely essential in this sector. Professional transport not only protects the product and the environment, but above all supports the uninterrupted operation of a chemical plant a value far greater than any short-term saving.

Audits, certifications and ESG. New standards of responsibility

Audits, certifications and ESG have become some of the key pillars of modern chemical industry operations. Companies in this sector are subject to an extensive system of oversight that includes customer audits, internal audits and independent external assessments such as SQAS (Safety and Quality Assessment System). Developed by the European chemical industry, the SQAS system provides a unified method for evaluating transport safety, the quality of operational processes, compliance with environmental regulations and the overall readiness of companies to manage risk situations. The results of these audits are not used solely for verification, they are also a tool for improving logistics processes and for building trust between producers and carriers. ESG reporting is also gaining importance, covering a company’s environmental impact, social responsibility and the quality of corporate governance. For chemical companies, this area is particularly sensitive, as the nature of their operations requires them to constantly demonstrate that both production and logistics processes are carried out responsibly and transparently. ESG reports are becoming an essential element of market communication and form the basis for investment and tender decisions. Chemical companies expect their carriers to be equally prepared to meet these requirements. This includes both readiness to participate in audits and the ability to provide data necessary for assessing compliance with environmental and social regulations. Logistics partners effectively become part of the responsible development strategy, which means their safety procedures, work culture, operational standards and management quality must align with the expectations of the sector. In practice, this means that a professional carrier not only provides transport but also co-creates the broader system of safety and responsibility that underpins the credibility of the entire chemical industry. At the same time, the Polish chemical sector is heavily investing in ESG-driven initiatives. Expenditures on environmental protection account for an average of 20–30 percent of total capital investments in the chemical industry and are 3–4 times higher than in other manufacturing sectors. This demonstrates not only the industry’s strong commitment to sustainable development but also the growing importance of responsible supply chains, in which certified and conscious transport partners play a crucial role. (www.pekao.com.pl)

Key trends and challenges of the modern chemical industry

The Polish chemical industry operates today in an environment of rapidly evolving regulatory, technological and environmental conditions. Companies must simultaneously respond to rising market expectations, climate pressure and increasingly complex requirements related to safety and sustainable development. According to the Polish Chamber of Chemical Industry, the areas below represent the main directions of transformation and the most pressing challenges currently facing the sector.

Ecological transformation

The industry is implementing initiatives that support the path toward climate neutrality and is developing environmentally friendly technologies.

Decarbonisation

Companies are working to reduce CO₂ emissions by modernising their facilities and increasing energy efficiency.

European Green Deal

The sector is adapting to the EU strategy aimed at achieving climate neutrality and reducing environmental degradation.

Fit for 55 package

In line with EU objectives, companies are preparing to reduce greenhouse gas emissions by 55 percent by 2030.

CE

The industry is implementing product and process design models that keep raw materials in circulation for as long as possible (Circular Economy).

SUP Directive

Companies are reducing the use of single-use plastics and adapting their processes to new environmental requirements.

EPR

Companies are preparing for obligations related to packaging waste and the financing of its management in line with the Extended Producer Responsibility framework.

Sustainable chemicals

Requirements are increasing regarding product safety and the reduction of undesirable substances.

ESG

Companies are placing greater emphasis on environmental impact, social responsibility and transparent corporate governance.

Why professional transport is becoming a key element in the future of the chemical industry

The chemical sector is transforming faster than ever, and the level of requirements is rising alongside new regulations, environmental pressure and expectations for full process transparency. In this environment, carriers must meet the highest operational, safety and communication standards, because logistics directly determines production continuity, delivery stability, the protection of people and the environment and compliance with extensive legal regulations. Every stage of transport matters, and its quality forms an integral part of the overall safety of a chemical facility. Transport is no longer a purely operational function, it is increasingly becoming a strategic element that shapes the performance of the entire value chain. Moreover, as exports continue to grow in importance, professional transport is emerging as one of the key pillars of the chemical industry’s future.

In 2024, Polish chemical industry exports reached 48.9 billion EUR (210.6 billion PLN). The main export markets: Germany, the Czech Republic, France, Italy and the United Kingdom, require precisely planned deliveries that comply with European regulations and local operational standards. In such conditions, the carrier is responsible not only for punctuality but also for transport quality, ESG compliance, documentation handling and maintaining supply chain continuity in a high-risk environment. Chemical companies expect their logistics partners not only to execute transport orders, but also to understand the specific characteristics of the substances involved, respond flexibly to changing production needs, follow plant-specific procedures and operate effectively in a high-risk environment. The carrier must not only deliver the product but also actively contribute to a robust safety system that minimises operational risk. (www.pipc.org.pl)

Euro24 supports the chemical industry comprehensively, offering both ADR transport and temperature-controlled transport. Our experience in handling hazardous substances ensures full regulatory compliance, complete operational transparency and safety at every stage of the process. Euro24 vehicles are equipped in accordance with ADR requirements, and our drivers hold up-to-date qualifications and take part in regular training. This allows us to handle both standard chemical shipments and high-risk cargo, whether they are destined for production plants in Poland or for markets across Western Europe.

Temperature-controlled transport

Temperature-controlled transport is a logistics service designed for products that require strictly defined thermal conditions. It is a key solution for sectors such as FMCG (food, beverages, cosmetics), pharmaceuticals and chemicals, where short shelf life and high loss potential make service quality and reliability an absolute priority.

For substances sensitive to environmental conditions, we provide temperature-controlled transport that maintains stable parameters throughout the entire journey. Continuous temperature monitoring, rapid response to deviations and real-time status updates support both material safety and full compliance with customer requirements. As a result, even the most demanding chemical products reach their destination in perfect condition.

Professional logistics in the chemical industry is no longer just a tool supporting plant operations, it has become a real factor shaping competitiveness. Euro24 combines regulatory expertise, operational experience and modern infrastructure to create a stable logistics foundation that chemical companies can safely rely on. As a result, transport becomes not only a service but also a key element of responsible and efficient growth for the chemical industry.

Sources:

www.pipc.org.pl Report: The Chemical Industry in Numbers. PIPC report for Q2 2025.

www.pipc.org.pl Report: The Chemical Industry in Poland. November 2025.

www.pekao.com.pl Report: In Search of the Green Middle. Current Situation, Challenges and Prospects of the Chemical Sector in Poland.

Have questions?

Write to us. Together, we’ll find the right solutions for your transport needs. Schedule a “virtual coffee” with our Client Manager and learn how we can provide the level of cooperation comfort you’re looking for.

Find out how we can support your business.